georgia property tax relief

It was founded in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and accredited with the International Association of Professional Debt Arbitrators. Cobb Cherokee and Forsyth Counties are among those providing an exemption from the school tax portion of property taxes for those using their GA home as their primary residence.

2021 Property Tax Bills Sent Out Cobb County Georgia

Call or email us for a chart showing savings for most Metro Counties.

. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results to lower commercial property taxes as well as residential property taxes. Consumer Ed says. 2022 Latest Homeowners Relief Program.

The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs. We can help you significantly reduce the taxes on your Georgia home or commercial property. You must request an extension by July 15 2020.

Individuals 65 years or older may claim a 4000 exemption from all state and county ad. The amount for 2020 is 98492. 2021 Property Tax Relief for Georgia Manufacturers.

County Property Tax Facts. Property Tax Millage Rates. CuraDebt is a debt relief company from Hollywood Florida.

Georgia Property Tax Relief Inc. Property Taxes in Georgia. If a federal extension is filed Georgia will accept it and if one is not filed Georgia Form IT-303 should be filed.

Granbury Tx Steak Restaurants. Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income. 3435 Buford Hwy Duluth Georgia 30096 United.

Georgia Property Tax Relief Inc. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results to lower commercial property taxes as well as residential property taxes. Georgia manufacturers can receive temporary property tax relief for property tax year 2021 with the passage of HB 451 which expands the states Level 1 Freeport Inventory Exemption.

It is stated by 2016 all senior retirement income will be exempt. On the bright side the Georgia General Assembly has been successful in offering property tax incentives which provide significant tax relief for agricultural lands forest lands environmentally sensitive areas and residential transitional properties which have saved landowners millions of dollars in tax relief. ATLANTA Governor Sonny Perdue today announced that he has signed House Bill 1055 a bill that eliminates taxes on retirement.

Tax Benefits in Georgia. DeKalb County offers our Senior Citizens special property tax exemptions. New Life Recovery House.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Nassau County Tax Grievance Deadline 2022. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases.

Property Tax Returns and Payment. Our staff has a proven record of substantially reducing property taxes for residential and commercial clients. But capping the annual value increase in property assessments in the name of property tax relief is bad policy for Georgia and no answer to property tax woes.

As a result owners of similar properties often pay tremendously disparate property taxes. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. The Freeport exemption offered by several of the states local governments allows Georgia manufacturers.

About the Company Georgia Property Tax Relief Age 65 CuraDebt is a company that provides debt relief from Hollywood Florida. Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts etc. Information about actions being taken by the US.

For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax commissioners office. About the Company Georgia Property Tax Relief Bill. Corona Virus Tax Relief FAQs.

Pearl Street Restaurants Open. Georgia Property Tax Relief Inc. The value of the property in excess of this exemption remains taxable.

It was established in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. Press Releases For more information about the COVID-19 virus please visit.

Check If You Qualify For 3708 StimuIus Check. Riverside Sales Tax Office. This does not apply to or affect county municipal or school district taxes.

Assessment caps artificially suppress the taxable value of property that does not change ownership. However this was further increased in 2012 to 130000. Georgia Property Tax Relief.

This break can drop annual property taxes to well below 2000yr for most seniors. Coronavirus Tax Relief FAQs. Our staff has a proven record of substantially reducing property taxes for residential and commercial clients.

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt from the. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence.

Centers for Disease Control and Prevention CDC for health information. Find company research competitor information contact details financial data for Georgia Property Tax Relief Incorporated of Duluth GA. Get the latest business insights from Dun.

The median property tax in Georgia is 134600 per year for a home worth. Property Tax Homestead Exemptions.

Irs Gives Expanded Tax Relief To Victims Of Hurricane Matthew Parts Of Four States Eligible Extension Filers Have Until Ma Tax Deadline Irs Hurricane Matthew

2021 Property Tax Bills Sent Out Cobb County Georgia

What Is A Homestead Exemption And How Does It Work Lendingtree

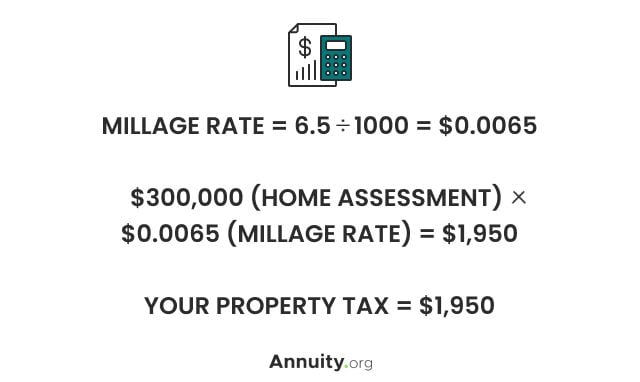

Property Taxes Calculating State Differences How To Pay

Deducting Property Taxes H R Block

What Is Tax Relief Homeowner House Protecting Your Home

Solar Property Tax Exemptions Explained Energysage

Property Overview Cobb Tax Cobb County Tax Commissioner

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Tax Benefits Of Owning Rural Land In 2021 Estimated Tax Payments Tax Deductions Business Tax Deductions

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Every Year We Rank The Best States For Solar Power And The Worst Learn All About State Solar Policy And Incentives Li Solar Power Solar Data Visualization

State By State Guide To Taxes On Retirees Retirement Advice Retirement Best Places To Retire

Property Tax Homestead Exemptions Itep

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax